"I Used To Carry A Wallet, Now I Just Need To Carry My Phone": Understanding Current Banking Practices and Challenges Among Older Adults in China

Abstract

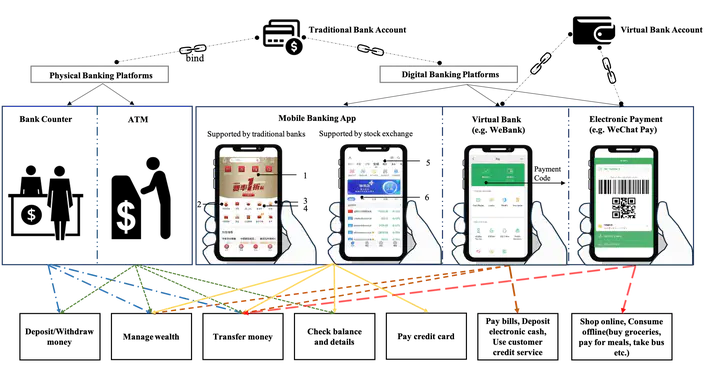

Managing finances is crucial for older adults who are retired and may rely on savings to ensure their lives’ quality. As digital banking platforms (e.g., mobile apps, electronic payment) gradually replace physical ones, it is critical to understand how they adapt to digital banking and the potential frictions they experience. We conducted semi-structured interviews with 16 older adults in China, where the aging population is the largest and digital banking grows fast. We also interviewed bank employees to gain complementary perspectives of these help givers. Our findings show that older adults used both physical and digital platforms as an ecosystem based on perceived pros and cons. Perceived usefulness, self-confidence, and social influence were key motivators for learning digital banking. They experienced app-related (e.g., insufficient error-recovery support) and user-related challenges (e.g., trust, security and privacy concerns, low perceived self-efficacy) and developed coping strategies. We discuss design considerations to improve their banking experiences.